Your Guide to Small Business Tax Write Offs

- Bryan Wilks

- 3 days ago

- 17 min read

Think of tax write-offs less like a chore and more like a secret weapon for your business. Simply put, they are qualified business expenses you can subtract from your total income, which lowers the amount of that income you have to pay taxes on.

It’s about strategic spending that shrinks your tax bill and puts cash back into your pocket—cash you can then turn around and reinvest right back into your business.

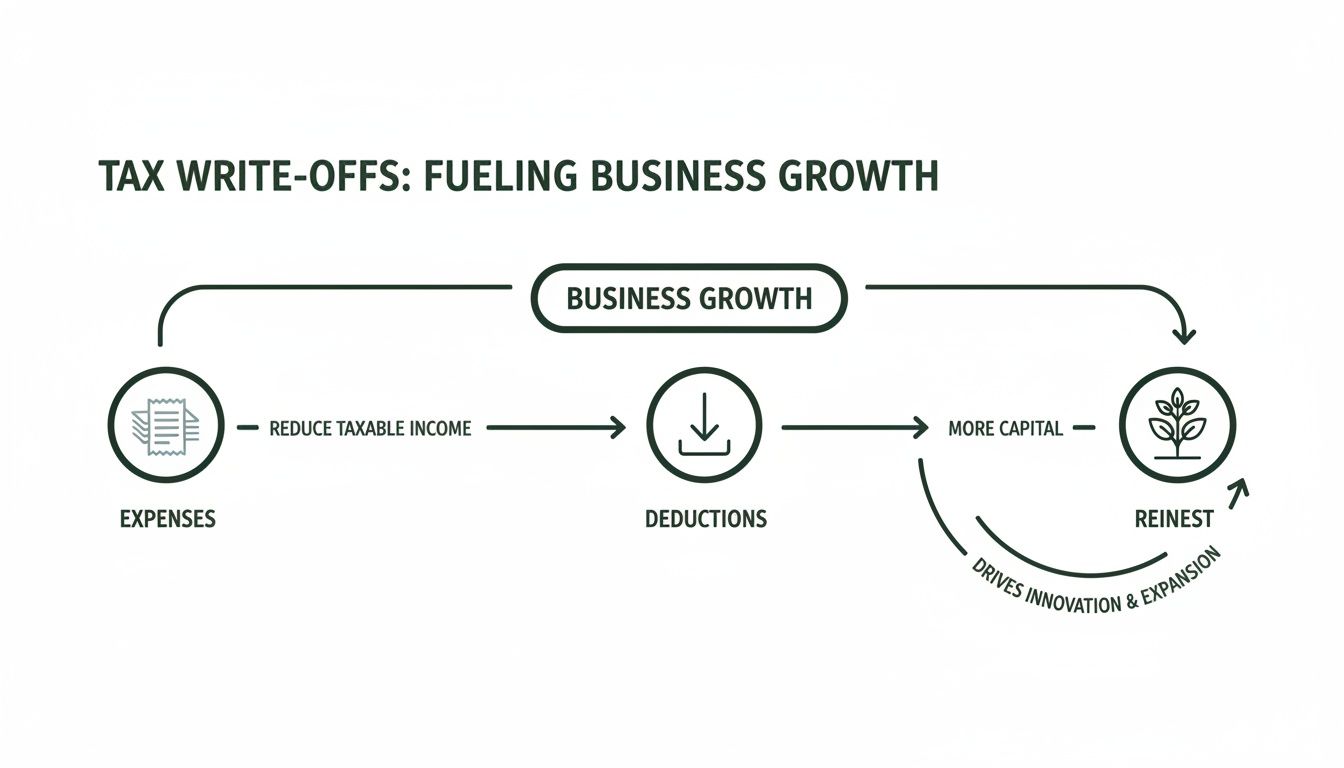

How Tax Write-Offs Fuel Your Business Growth

Too many entrepreneurs see expenses as a painful, but unavoidable, part of doing business. But what if you started looking at them as fuel? Every legitimate expense is an opportunity to lower what you owe the IRS.

This shift in mindset is a game-changer. From your membership at a dynamic hub like Freeform House to the miles you drive for client meetings, these aren't just costs; they are investments that pay you back.

This guide is here to pull back the curtain on tax deductions for entrepreneurs in Jenks and Tulsa. We'll show you how turning everyday costs into powerful deductions is one of the smartest financial moves you can make. These strategies aren't just for big corporations—they're essential for your small business's survival and success.

The Core Principle: Ordinary and Necessary

The IRS has a simple rule of thumb for what counts as a write-off. Any expense you claim must be both "ordinary and necessary" for your line of work.

What does that really mean?

An ordinary expense is one that’s common and accepted in your industry.

A necessary expense is one that’s helpful and appropriate for your business—you don't have to prove it's indispensable, just that it helps you do your job.

So, as long as the expense is directly tied to your business operations, you’re likely in the clear. For example:

A coworking membership: The fees for a space like Freeform House are deductible because you use it to work, meet with clients, or network.

Professional services: Did you hire an accountant to sort out your books or a lawyer to draft a contract? Those fees are 100% deductible.

Software subscriptions: Your accounting software, project management tools, and other digital subscriptions are all necessary expenses for running a modern business.

This image shows the kind of modern, collaborative environment at Freeform House that members can use for business, making membership fees a potential write-off.

The big takeaway here is that investing in professional spaces, tools, and advice isn't just an expense; it’s a smart financial decision with a direct tax benefit.

Tapping into High-Impact Deductions

When it comes to big-ticket purchases, you have some seriously powerful tools at your disposal. A great example is Section 179 expensing, which offers immediate and significant tax relief.

Imagine you're outfitting a space like the 10,000-square-foot club at Freeform House or buying new gear for the Rise loft studio. For 2025, the cap on this deduction is increasing substantially. This means you could potentially deduct the full cost of major assets—like a professional podcast booth or new office furniture—in the same year you buy them.

As NerdWallet points out, these write-offs directly shrink your taxable income. The catch? You have to keep meticulous records on Form 4562 to justify the deduction and stay off the IRS's radar.

Getting these foundational concepts right is the first step toward building a smarter financial strategy. To learn more about how tax savings can fund your next big idea, check out our guide on 10 essential small business growth strategies for local entrepreneurs in 2026.

Alright, now that we've covered the golden rule of tax write-offs—that they must be "ordinary and necessary"—let's dig into the good stuff. This is where you can find some serious savings for your small business.

Most entrepreneurs know they can write off their office rent, but that's just scratching the surface. So many other expenses, from the obvious to the easily missed, can trim down your taxable income. The miles you drive to grab coffee with a client, the software you use to send invoices... every single cost is a potential tax deduction.

Here, we'll break down the most common and impactful write-offs. I'll give you real-world examples and walk you through the different ways you can claim them, so you feel ready and confident when tax time rolls around.

Your Workspace: Home Office and Coworking Memberships

Your workspace is usually one of your biggest line items, making it a goldmine for deductions. This applies whether you're working from a spare room at home or a vibrant hub like Freeform House.

Home Office Deduction: Got a dedicated space in your home that you use exclusively and regularly for your business? You can claim the home office deduction. You've got two ways to do this: * The Simplified Method: This is the no-fuss option. You can deduct $5 per square foot for up to 300 square feet of your office space. That's a straightforward deduction of up to $1,500 with minimal paperwork. It's a fantastic, easy win. * The Actual Expense Method: This one requires more meticulous tracking, but the payoff can be much bigger. You figure out the percentage of your home's total square footage that your office occupies. Then, you deduct that same percentage of your actual home expenses—things like mortgage interest, rent, utilities, insurance, and repairs.

Coworking and Shared Spaces: For so many of us today, a membership at a place like Freeform House is non-negotiable. The good news is that your membership fees for coworking spaces, any conference rooms you rent, or even booking a podcast studio are typically 100% deductible as a standard business operating expense.

The name of the game is documenting the business purpose. Whether it's your main office, a spot to impress clients, a place for a team meetup, or a networking hub, those membership fees are directly fueling your business. That makes them a clear and valid write-off.

Vehicle Expenses: Making Your Miles Count

If you use your personal car for business—visiting clients, running to the supply store, or heading to a conference—those miles add up to real money. Just like the home office deduction, you have two ways to calculate it.

Standard Mileage Rate: This is the easy route. The IRS sets a standard rate each year (for example, it was 67 cents per mile in 2024). You just need to keep a log of your business mileage and multiply it by that rate. Simple. You can also add on any business-related parking fees and tolls.

Actual Expense Method: With this approach, you track everything: gas, oil changes, insurance, new tires, registration, and even the depreciation of your vehicle. You then calculate the percentage of time you used the car for business and deduct that portion of your total costs.

Honestly, for most small business owners, the standard mileage rate is the way to go. It's far less of a headache and often gives you just as big of a deduction, if not bigger.

To help you identify potential savings at a glance, here’s a quick rundown of common expenses and how you can deduct them.

Common Business Expenses and Deduction Methods

Expense Category | What It Covers | Common Deduction Method(s) |

|---|---|---|

Home Office | A dedicated, exclusive space in your home for business. | Simplified Method ($5/sq ft) or Actual Expense Method (% of home costs). |

Coworking Space | Membership fees, dedicated desk rentals, meeting room bookings. | Actual Expense (100% of the cost is typically deductible). |

Vehicle Use | Miles driven for client meetings, supply runs, business errands. | Standard Mileage Rate (IRS rate per mile) or Actual Expense Method (% of total car costs). |

Business Travel | Airfare, hotels, rental cars for out-of-town business trips. | Actual Expense (100% of transport and lodging costs). |

Business Meals | Food and drinks with clients, partners, or during travel. | 50% of the Actual Cost (must have a clear business purpose). |

Supplies & Software | Pens, paper, subscriptions (e.g., QuickBooks, Adobe), web hosting. | Actual Expense (100% of the cost). |

Professional Fees | Payments to accountants, lawyers, consultants, or coaches. | Actual Expense (100% of the cost). |

This table is a great starting point, but remember to keep solid records for whichever method you choose.

This is what we mean when we talk about the growth cycle. Every dollar you save on taxes is a dollar you can put right back into your business.

By being smart about tracking your expenses and claiming every deduction you're entitled to, you create more cash flow to invest in scaling up.

Everyday Operations: Supplies, Software, and Services

It’s not just the big-ticket items that count. The daily costs of keeping the lights on add up fast, and they're some of the most frequently missed write-offs.

A few examples of deductible operating costs include:

Office Supplies: Yep, all of it. Pens, printer paper, ink, notebooks—the works.

Software and Subscriptions: Your accounting software (like QuickBooks), project management tools (like Asana), cloud storage fees, and any industry-specific online subscriptions.

Professional Services: The money you pay your accountant, lawyer, or a business coach is an investment in your company's success, and it's fully deductible.

Bank Fees: Those pesky monthly service charges and transaction fees on your business bank account? Deductible.

Startup Costs and Business Losses

Getting a business off the ground, especially one like Freeform House with its unique amenities, takes a serious upfront investment. Thankfully, the IRS lets you deduct many of these initial hurdles.

You can deduct up to $5,000 in startup costs in your first year of business, which can cover things like market research, creating a business plan, or legal fees for setting up your LLC. It's shocking, but one study found that 93% of businesses miss out on deductions they're entitled to. That's why it's so critical to get a handle on these rules from the very beginning. For a deeper dive, NerdWallet has a great guide covering over 21 different deductions.

Travel, Meals, and Entertainment

The rules here can feel a little fuzzy, so it’s important to get them right.

Business Travel: When you have to travel away from your home city for work, you can deduct 100% of your airfare, rental cars, and hotel stays.

Business Meals: You can generally deduct 50% of the cost of a meal with a client, partner, or even your team, but you have to show there was a clear business purpose.

Entertainment: This is a big one that changed recently. Under the Tax Cuts and Jobs Act (TCJA), you can no longer deduct expenses for entertainment. That means tickets to a ball game or a concert are off the table, even if you bring a high-value client.

Getting the details right in these categories makes all the difference. For instance, if you're weighing different workspace options and their financial impact, you might find some helpful insights in our guide on the true coworking space cost for your business.

Advanced Write Offs and High Impact Deductions

Once you've got a handle on the day-to-day write-offs, it's time to talk about the deductions that can really move the needle. These are the strategies that go beyond mileage logs and supply receipts, delivering major tax savings that free up serious cash to pour back into your business.

These high-impact deductions usually involve a bit more long-term planning, like setting up a retirement fund or investing in big-ticket assets. For any serious entrepreneur, understanding how they work isn't just helpful—it's crucial for building a smarter financial strategy and a more profitable, resilient business.

Unlocking the Qualified Business Income Deduction

One of the most powerful tools in the small business owner’s tax kit is the Qualified Business Income (QBI) deduction. This one is a genuine game-changer for a lot of folks.

Imagine you run a premium workspace like Freeform House in downtown Jenks. Every dollar saved on taxes is another dollar you can use to build more creative studios or host networking events for other local entrepreneurs. That’s where the QBI deduction comes in. Born from the 2017 Tax Cuts and Jobs Act (TCJA), it allows owners of pass-through businesses—we're talking sole proprietors, LLCs like Freeform's setup, S-corps, and partnerships—to potentially slash up to 20% off their qualified business income.

Here's how it plays out: If your business nets $100,000 in profit from memberships, events, and podcast booth rentals, you could deduct a massive $20,000. You'd only be taxed on $80,000 of that income. For 2024, the full deduction is available to those with incomes below $191,050 (single) or $382,050 (married filing jointly). You can find more insights on this and other deductions over at Brex.com.

This deduction basically creates a lower tax rate on your business profits. But it’s not a free-for-all; it comes with specific income limits and rules depending on your industry, so you’ll need to confirm you qualify to take full advantage of this break.

Writing Off Employee Benefits

Offering benefits isn't just a smart way to attract and keep great people—it's also a fantastic tax strategy. The costs you sink into key benefits are generally 100% deductible.

Think of it as a win-win. These write-offs directly chip away at your taxable income while also acting as an investment in your team's happiness and loyalty.

Key Deductible Benefits:

Retirement Plan Contributions: When you sponsor a plan like a SEP IRA, SIMPLE IRA, or Solo 401(k), the contributions you make for your employees (and yourself) are tax-deductible.

Health Insurance Premiums: The money you pay toward your team's health insurance is a deductible business expense. If you're self-employed, you can usually deduct 100% of your own premiums, too.

Education Assistance: Helping your employees with tuition or other professional development? You can deduct up to $5,250 per employee each year.

Depreciation Section 179 and Bonus Depreciation

When you buy a major asset for your business—new computers, office furniture, a company vehicle—you usually can't just write off the entire cost at once. Instead, you deduct a piece of its value over several years. This is called depreciation.

But two powerful rules let you speed things up and grab a huge deduction right away.

Think of it this way: Standard depreciation is like sipping a drink slowly over the evening. Section 179 and Bonus Depreciation are like taking a big, satisfying gulp right at the start. Both get the job done, but the second one gives you a much faster kick.

Section 179: This lets you deduct the full purchase price of qualifying new or used equipment in the year you start using it. For 2024, the cap on this is a hefty $1.22 million.

Bonus Depreciation: This lets you immediately deduct a big chunk of the cost of new and used assets. For 2024, you can write off 60% of the asset's cost upfront. This percentage is set to decrease over the next few years, so it's a bit of a time-sensitive opportunity.

This image shows an entrepreneur consulting with a financial advisor, a common scenario when planning for high-impact deductions like depreciation or QBI.

Getting this kind of professional advice is, by the way, a deductible expense in itself—an investment in your business's financial health.

The Value of Professional Services

And that brings us to our final point: never forget that the fees you pay for professional advice are deductible investments, not just costs. This covers what you pay your accountant, bookkeeper, lawyer, or business consultant.

Hiring these pros helps keep you compliant, guides you toward smarter financial moves, and ensures you're squeezing every last drop out of available tax write-offs. The money you spend on their expertise is a classic "ordinary and necessary" expense that directly supports your business, making it fully deductible.

Mastering Your Documentation and Record Keeping

A potential small business tax write off is completely worthless without proof. Honestly, claiming deductions is only half the battle. The other half is proving those expenses are legit if the IRS ever comes knocking. This is where meticulous documentation becomes your best friend, turning that tax-season uncertainty into solid confidence.

Think of your records like the foundation of a house. If it's shaky or poorly organized, the whole thing is at risk. It’s the same with your tax claims—without solid proof, they're vulnerable. The goal here is to build an audit-proof trail that clearly and undeniably supports every single deduction you take.

This isn’t about becoming a CPA overnight. It’s about putting a simple, sustainable system in place that actually works for you and your business. With the right tools and a few consistent habits, you can build a rock-solid financial record that lets you claim every deduction you rightfully deserve.

Building Your Audit-Proof System

A reliable record-keeping system really just comes down to a few non-negotiable steps. Get these core practices down, and you'll protect your business and keep your finances crystal clear.

First and foremost: separate your business and personal finances. This is the golden rule, no exceptions. Open a dedicated business bank account and get a separate business credit card. When you run all your business income and expenses through these accounts, you create a clean, easy-to-follow paper trail. Mingling funds is one of the biggest red flags for the IRS, so just don't do it.

Next, you have to embrace a little bit of modern tech. Today’s accounting software and receipt-scanning apps are a game-changer for small business owners.

Accounting Software: Tools like QuickBooks or Xero can automate so much of the grunt work. They link right up to your business bank accounts, help categorize transactions, and spit out the financial reports you'll need at tax time.

Receipt-Scanning Apps: An app like Dext or Expensify lets you just snap a photo of a receipt the second you get it. The app pulls the info, stores it safely in the cloud, and can even sync with your accounting software. Say goodbye to that shoebox full of faded receipts.

A Real-World Example from Freeform House

Let’s imagine a freelance graphic designer and Freeform House member named Alex. Alex has a simple but super-effective system for tracking every potential tax write-off, and it brings a ton of peace of mind.

For Alex, documentation isn't some dreaded chore; it's just part of the routine. Every expense is a data point that makes the business financially stronger. By capturing the details right away, nothing slips through the cracks, and every single deduction can be justified.

Here’s a look at Alex's typical weekly workflow:

Monday Morning Coffee: Alex meets a potential new client at a coffee shop in Jenks. Right after paying, Alex snaps a picture of the receipt with a scanning app and adds a quick note: "Client meeting w/ Jane Doe re: Project X." Boom. Logged and categorized.

Wednesday Workspace: Alex camps out at Freeform House for the day to knock out a big project. The monthly membership fee is paid automatically with the business credit card, so a perfect digital record is already waiting in the accounting software.

Friday Mileage: Before heading to a client's office in Tulsa for a project kickoff, Alex fires up a mileage-tracking app. It logs the whole trip, calculates the mileage, and saves all the details. Calculating the vehicle deduction later will be a breeze.

By sticking to this simple process, Alex builds a complete, real-time record of all business activities. No more guesswork or frantic searching for receipts in March. This system means Alex can confidently claim every deduction earned. Having a well-documented business location is also key; you can learn more by checking out our guide on the physical address vs mailing address for your business.

How to Claim Deductions on Your Tax Forms

Alright, you’ve done the hard part. You’ve diligently tracked your expenses all year, saved your receipts, and now you have a solid grasp on what counts as a write-off. The next step is connecting all that effort to the official paperwork.

This part can feel a little intimidating, but it’s really just a matter of putting the right numbers in the right boxes. This is where your meticulous record-keeping translates into actual, tangible tax savings. The goal here isn’t to turn you into a CPA, but to demystify the forms so you can have a smarter conversation with your CPA and understand where your money is going.

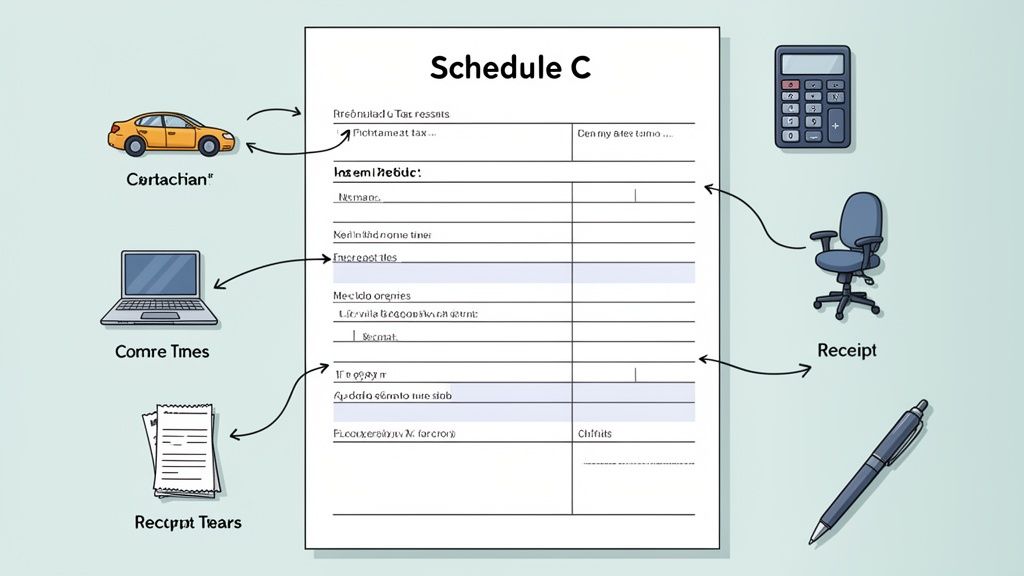

For Sole Proprietors and LLCs: The Schedule C

If you’re a sole proprietor or a single-member LLC, your new best friend is the Schedule C (Form 1040), Profit or Loss from Business. This is an attachment that tags along with your personal tax return. On it, you’ll list all your business income and then subtract your expenses to figure out your net profit or loss.

Think of Schedule C as the grand summary of your business's financial year. Part II, simply titled "Expenses," is where all your hard work pays off. The IRS even provides specific lines for many of the most common small business tax write offs we've already covered.

Key Lines on Schedule C to Know:

Line 9, Car and truck expenses: This is where your vehicle deductions land, whether you’re using the standard mileage rate or the actual expense method.

Line 20, Rent or lease: Your coworking space membership, office rent, or that fancy printer you're leasing all go here.

Line 22, Supplies: All the money you spent on paper, ink, pens, and other day-to-day office materials gets reported on this line.

Line 24a, Travel and Line 24b, Meals: This is where you’ll separate your deductible travel costs from your business meal expenses.

Line 27a, Other expenses: This is the catch-all category for deductions that don't have their own dedicated spot. Think software subscriptions, bank fees, or that online course you took for professional development.

How Other Business Structures Report Deductions

While the Schedule C is the go-to for most solo entrepreneurs, different business structures use different forms. The principle is exactly the same—report your income, subtract your expenses—but the paperwork has a different name.

Partnerships: Any business with multiple owners will typically file Form 1065, U.S. Return of Partnership Income. This form calculates the business's total profit or loss, with deductions reported much like on a Schedule C. That final number then "passes through" to each partner's personal return via a Schedule K-1.

S Corporations: S corps file Form 1120-S, U.S. Income Tax Return for an S Corporation. Just like partnerships, the S corp tallies its deductions on this main form to find its net income, which then flows through to the shareholders' personal taxes on a Schedule K-1.

No matter the form, the fundamental process is the same. You start with your gross revenue, subtract your cost of goods sold, and then list your various operating expenses. The final number is your taxable business income, which is what you ultimately pay taxes on.

Staying Compliant and Avoiding Audit Red Flags

Let's talk about something that makes every small business owner a little nervous: the IRS. While the thought of an audit is stressful, the reality is that they're pretty rare—fewer than 1% of returns get a second look. The key is to not give them a reason to look twice.

Think of it this way: if a claim seems too good to be true, it probably is. Deducting 100% of your vehicle use, for instance, implies you never once used that car for a personal errand. That’s a tough sell. The same goes for claiming meal or travel expenses that look suspiciously high compared to your actual revenue. Understanding these common triggers is your first line of defense.

Common Mistakes That Trigger Audits

By far, the biggest and most avoidable mistake is blurring the lines between your business and personal finances. Paying for groceries with your business debit card or covering a client dinner with your personal Visa creates a messy paper trail that auditors love to unravel. This co-mingling instantly casts doubt on the legitimacy of all your deductions.

A few other red flags will almost certainly attract unwanted attention:

Rounding Numbers: Filing a return with perfectly round numbers—like $5,000 for supplies or $2,000 for travel—screams "I guessed" instead of "I have receipts."

Claiming Large Losses: If your business reports major losses year after year, the IRS might start to wonder if it's a real business or just an expensive hobby.

Excessive Deductions: When your write-offs seem way out of proportion for a business of your size and in your industry, it’s going to raise some eyebrows.

When to Call in a Professional

Knowing your limits is a sign of a smart business owner. While DIY tax software can work for very simple returns, there are clear signals that it’s time to bring in a Certified Public Accountant (CPA). If you're dealing with anything complex—like operating in multiple states, depreciating significant assets, or trying to make sense of the QBI deduction—don't go it alone.

Think of a great CPA not as an expense, but as a strategic partner. They provide peace of mind, ensure compliance, and help you build a forward-looking financial plan that maximizes savings and supports long-term growth. Their fee is a deductible investment in your business's health.

A Few Common Questions About Tax Write-Offs

When you're wading through the world of business taxes, a few questions always seem to pop up. Let's tackle some of the most common ones head-on.

Can I Write Off My Coworking Membership?

Yes, you almost certainly can. If you're using a membership at a place like Freeform House for your business—whether it's your main office, a spot for client meetings, or just a place to get focused work done—that monthly fee is typically 100% deductible.

It falls squarely into the "ordinary and necessary" expense category, just like your internet bill or office supplies.

What's the Real Difference Between a Deduction and a Credit?

This one trips a lot of people up, but the distinction is crucial. Think of it this way: a tax deduction (or write-off) lowers your taxable income. So, a $1,000 deduction in a 24% tax bracket shaves $240 off your tax bill. Not bad.

A tax credit, on the other hand, is pure gold. It’s a dollar-for-dollar reduction of the actual taxes you owe. A $1,000 tax credit saves you the full $1,000. That's why credits are so much more powerful.

Do I Really Need a Receipt for Every Last Coffee?

While saving every single receipt is the safest bet, the IRS is a bit more flexible than you might think. Generally, you need solid proof for any single expense of $75 or more. For those smaller purchases, a clear entry in your accounting software or a categorized bank statement can often do the trick.

But there's a big exception: business travel. For any lodging expenses and most business meals on the road, you absolutely need to keep detailed receipts, no matter the cost. My advice? When in doubt, just snap a picture of the receipt. Digital copies are perfectly fine and a whole lot easier to organize.

Ready to connect with a community that understands your ambition? At Freeform House, your membership is more than just a workspace—it's an investment in your network and a powerful business deduction. Discover how our community can fuel your growth.

Comments